Before diving into the growth of music streaming in China, let’s take a look at the growth of the global music market to get an idea of the numbers we are talking about.

The revenues of the global record music market grew 7.4% in 2020, which has been the sixth consecutive year of growth. Globally, streaming revenues grew by 19.9% and has continued to grow each year since 2004 and is now approaching 50% of the total revenues. Unlike other sources such as downloads, physical sales, performance rights and synchronization, which have declined.

In Asia in 2020, the digital revenues of the music market surpassed a 50% share of the region’s total revenues and its recorded music revenues grew by 9.5%. Without Japan’s decline, Asia would have been the fastest growing market (29.9%) instead of Latin America (15.9%).

China is still the 7th biggest music market in the world, behind South Korea and before Canada. China’s roots in its rise in music streaming has come from a major cultural shift in its protection and value of copyrights during this decade. Our previous blog highlights this shift.

In China, the revenue of streaming music has grown from 59 million USD (2011) to 1.94 billion USD (2019) and continues to rise. This growth is due to a huge increase in paid subscriptions and is likely to have been influenced by Covid: Paid listeners grew from 25% in 2019 to 61% in 2021. Ifpi noted in a listener survey in this summer (2021) that 92% used music for emotional wellbeing, likely influencing the rise in consumption from 17.7 hours in 2019 to 22.9 hours.China also has one of the highest amounts of streaming mobile app users in the world with 66% (2020).

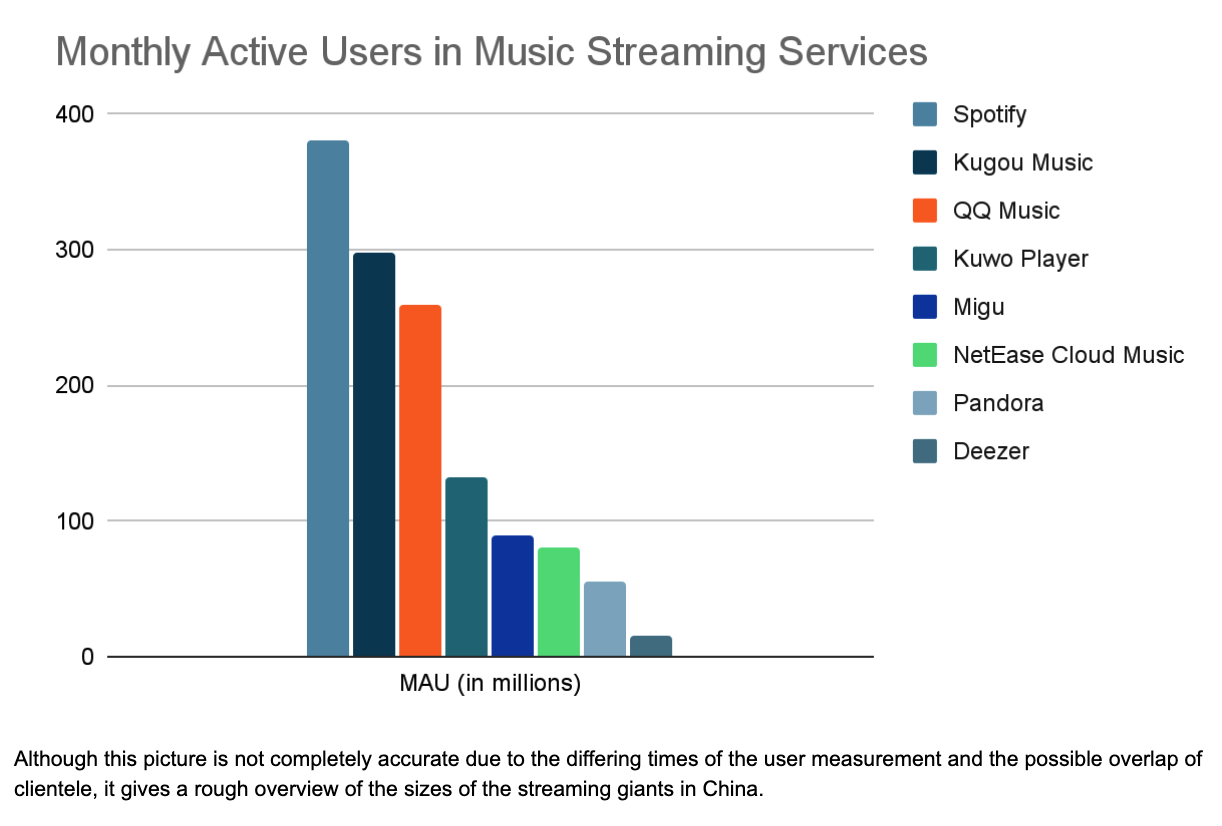

Compare the amounts of Monthly Active Users (MAU) between the best Chinese and Western music streaming services. The MAUs in China's top streaming services outweighs that of the top streaming services in the West. Tencent Music Entertainment collectively has 689 mil. MAUs with Kugou at 298 mil., QQ at 259 mil., and Kuwo at 132 mil. In comparison to the services not available in China, with Spotify at 381 mil., Pandora at 55 mil., and Deezer at 15 mil. MAUs.

In addition to the mainstream streaming services China has many different services such as short video services, online karaoke and online radios, which pay royalties.

In addition to the mainstream streaming services China has many different services such as short video services, online karaoke and online radios, which pay royalties.

The growth in China can be seen in Musicinfo’s streaming numbers. In 2019 we had nearly 225 million streams and grew to over 570 million in 2020 and while the streaming numbers doubled, the amount of royalties paid out increased nearly sixfold. This is due to the increased amount of paid subscribers to the Chinese streaming services.

We at Musicinfo are ecstatic about the growth of streaming in China, this means more streams for our artists and more possibilities for you to make an audible mark on the Chinese music market, to get paid more.

The rise in streaming is a good thing. When physical sales are declining (except for vinyls, which is super cool) and live performances can still be difficult, music streaming is a lifeline for many artists.

There are a vast number of different music platforms available in China where listeners can find cool music: Your music. Many distributors might include China in their global distribution, but they usually only have a few of the major services. In this time of growth it is only logical to take this advantage and make your music available to as many places as possible, to get paid.

It is obvious there is a huge potential in China as the growth of the industry implies, though the music market is still fairly unknown to most Western artists and the number of people subscribing to premium streaming services in China is growing, elevating the payment rates in this copyright safe environment.

There are no sensible arguments for artists not to distribute their music to as many services as possible especially in China and make their mark on the local digital music milieu. To learn more about distributing to the Chinese market visit Musicinfo.

CVR FI24789448 | © Musicinfo 2026 | All rights reserved.